Since the UK officially left the European Union in 2020, businesses have faced a host of new challenges when it comes to managing their Importer of Record (IOR) responsibilities. One of the most significant changes is how businesses navigate customs procedures. If you’re still relying on a single entity in Amsterdam or another EU location to handle your imports to the UK, it’s time to reassess your supply chain strategy. In this blog, we’ll explore why having a presence in the EU alone is no longer enough for UK imports and how Global4PL’s IOR service can simplify your operations.

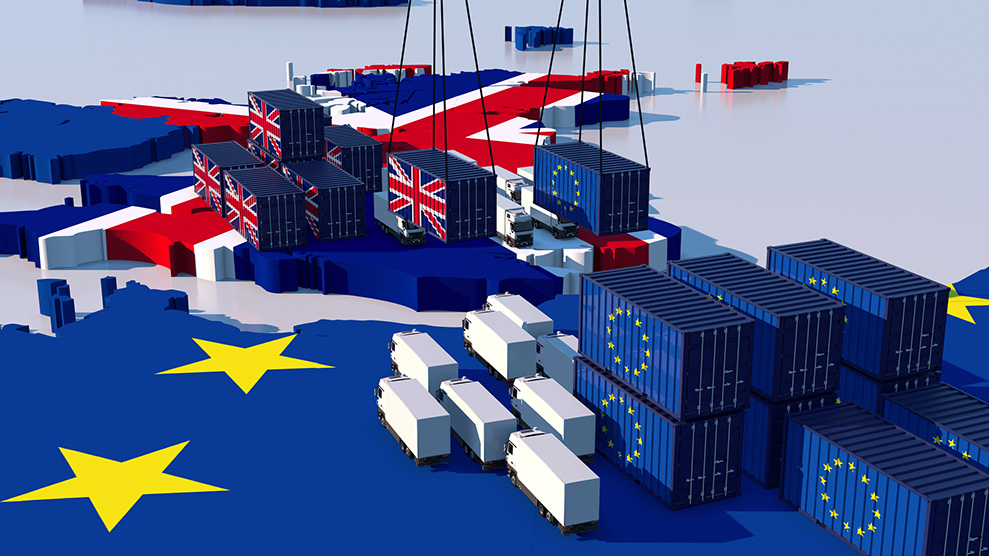

The Changing Landscape: UK and EU Are Now Separate Customs Territories

Before Brexit, the UK was part of the EU’s single market and customs union, which allowed businesses to trade goods seamlessly between the UK and EU. However, with the UK no longer in the EU, customs regulations have changed. The UK has its own customs requirements, tariffs, and regulatory obligations, separate from the EU.

As a result, businesses now need a UK-based Importer of Record (IOR) to handle their UK-bound imports. An IOR ensures that customs duties are paid, import taxes are filed, and that all necessary customs regulations are followed. If you are relying on a single entity in Amsterdam to manage all your imports, it’s time to make sure your supply chain is properly structured for the new post-Brexit reality.

Why Having an Entity in Amsterdam Is No Longer Sufficient

Before Brexit, many companies used an Importer of Record entity in Amsterdam or another EU location to manage their imports to both the UK and other EU countries. While this worked under the EU’s single market rules, post-Brexit, the UK operates under a separate customs system, meaning an EU-based IOR no longer meets the UK’s importation requirements.

Here’s why:

- Separate UK Customs Requirements: Since January 1, 2021, the UK has established its own customs procedures, which require a UK-based IOR. An entity based in Amsterdam or any other EU country cannot serve as your IOR for UK imports.

- VAT and Taxation Issues: The UK now has a separate VAT system from the EU. Businesses that import goods into the UK need to be VAT-registered there, which your EU-based IOR cannot manage. This can lead to compliance issues and potential penalties if not properly handled.

- Delays and Extra Costs: Using an EU-based IOR for UK imports can result in delays at customs, additional fees, and complications in meeting local regulatory requirements. UK customs authorities expect a UK Importer of Record to ensure compliance with customs procedures.

- Compliance with UK Legislation: The UK has specific import rules that can differ from the EU’s regulations. Without a local IOR, you risk non-compliance, resulting in fines or shipments being held up at customs. Ensuring your supply chain is in compliance with UK legislation is essential.

How Global4PL Can Help You With UK Importer of Record Services

At Global4PL, we specialize in offering comprehensive Importer of Record (IOR) services to businesses around the globe. Our UK-based IOR service ensures that your goods flow seamlessly through UK customs and that your supply chain stays compliant with all local regulations.

Here’s how we can help:

- UK Importer of Record Services: As your Importer of Record in the UK, we take on the responsibility of clearing your goods through UK customs. This includes ensuring that all customs duties and taxes are paid on time, helping you avoid costly delays.

- VAT Registration and Filing: We assist with VAT registration in the UK and handle all VAT-related matters for your imports. Our team ensures that you stay compliant with the UK VAT system, avoiding unnecessary penalties or fines.

- Customs Compliance: Our team stays updated on the latest UK customs regulations and ensures that your business complies with every necessary rule. This minimizes the risk of customs delays or issues in your supply chain.

- Streamlined Supply Chain Operations: With Global4PL as your trusted IOR, you don’t need to manage a complex web of entities. We handle the entire customs process, allowing you to focus on growing your business while we ensure your goods are imported to the UK efficiently and compliantly.

Conclusion: Don’t Let Post-Brexit Challenges Disrupt Your Supply Chain

The UK’s exit from the EU has changed the rules for importing goods into the country. Having an Importer of Record in an EU country is no longer sufficient for UK-bound shipments. To ensure smooth operations and compliance with UK customs requirements, you need a UK-based IOR.

At Global4PL, we provide end-to-end Importer of Record services that simplify your UK imports. Our team ensures that your goods move through customs without delays, your VAT registration is up to date, and your supply chain stays compliant with the latest regulations.

If you’re looking for a reliable partner to navigate the post-Brexit landscape, Global4PL is here to help. Reach out today to learn more about how our IOR services can keep your supply chain running smoothly and your imports to the UK fully compliant.

Get in Touch With Us Today!

Ensure your UK imports are compliant with the latest customs regulations. Contact Global4PL to learn more about our Importer of Record (IOR) services and how we can streamline your supply chain. Contact Us Now